TurboTax 2024 – File Your Taxes with 100% Confidence

TurboTax is designed to fit your unique tax situation. It searches for hundreds of deductions and credits and handles even the most complex tax situations, ensuring you get every dollar you deserve.

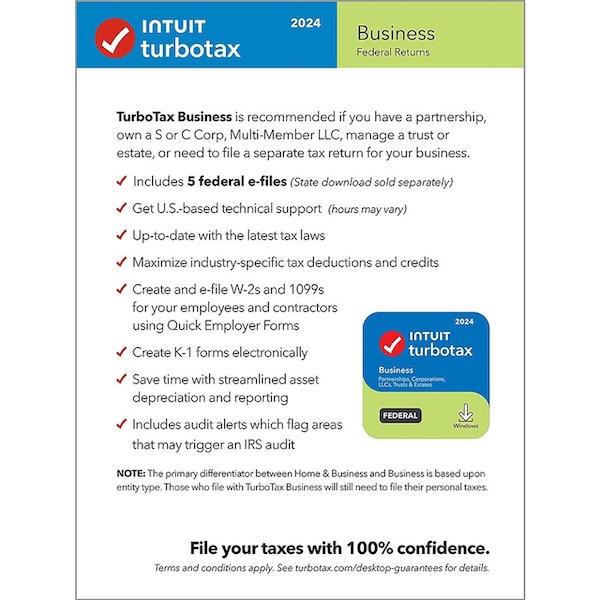

- Includes 5 Federal e-files and 1 State e-file via download (State e-file sold separately).

- Free U.S.-based product support (hours may vary).

- Downloaded software allows you to manage and view your tax data anytime (Intuit Account required).

- Maximize your bottom line with industry-specific small business tax deductions.

- Jumpstart your filing by importing info from last year’s TurboTax return or other tax software.

- Easily create and e-file W-2s and 1099s for employees and contractors with Quick Employer Forms.

- Stay updated with the latest tax laws for accurate and timely filings.

- Avoid mistakes by importing W-2s, investment, and mortgage information from participating companies.

- Get guidance on start-up costs that new businesses can deduct.

- Simplified asset depreciation and reporting for straightforward filing.

- TurboTax Audit Risk Meter™ checks your return for audit triggers.

- Runs thousands of checks before filing to identify any missing deductions or credits.

TurboTax Business is recommended if you:

- Need to file a separate tax return for your business.

- Have a partnership, S-Corp, or C-Corp.

- Manage a Multi-Member LLC, trust, or estate.

Key Details:

- TurboTax Desktop software is now available as download-only (CD not available).

- Requires an Intuit Account, internet connection, and activation for installation.

- Product limited to one account per license code.

- Accepting the TurboTax License Agreement is required. Not for use by paid preparers.

- Features, services, prices, and terms are subject to change without notice.

![TurboTax – Business 2024 Federal Only + E-file – Windows [Digital]](https://besthometaxx.com/wp-content/uploads/2025/05/TurboTax-–-Business-2024-Federal-Only-E-file-–-Windows-Digital.jpg)

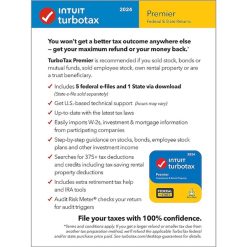

![TurboTax – Premier 2024 Fed + E-file & State – Mac OS, Windows [Digital]](https://besthometaxx.com/wp-content/uploads/2025/05/TurboTax-–-Premier-2024-Fed-E-file-State-–-Mac-OS-Windows-Digital-247x247.jpg)

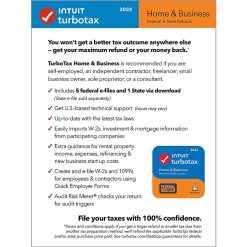

![TurboTax – Home & Business 2024 Federal + E-file & State – Mac OS, Windows [Digital]](https://besthometaxx.com/wp-content/uploads/2025/05/TurboTax-Home-Business-2024-Federal-E-file-State--247x247.jpg)

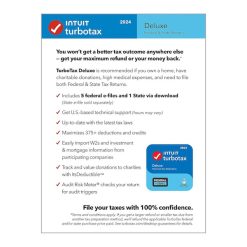

![TurboTax – Deluxe 2024 Federal + E-file & State – Mac OS, Windows [Digital]](https://besthometaxx.com/wp-content/uploads/2025/05/turbtaxdeluxe-247x247.jpg)

Reviews

There are no reviews yet.